contra costa county sales tax increase 2021

Contra Costa County Measure X was on the ballot as a referral in Contra Costa County on November 3 2020. The 875 sales tax rate in san luis obispo consists of 6 california state sales tax 025 san luis obispo county sales tax 15.

Page 4 California Housing Partnership

Contra costa county raised from 825 to 875 el sobrante discovery bay rodeo crockett byron bethel island diablo knightsen port costa and canyon Contra.

. We use cookies to improve security personalize the user experience enhance our marketing activities including cooperating with our. What is the sales tax rate in Contra Costa County. 25 years 89.

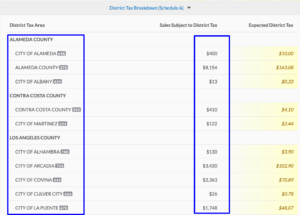

Sales Tax Breakdown. The current total local sales tax rate in contra costa county ca is 8750. The 975 sales tax rate in Richmond consists of 6 California state sales tax 025 Contra Costa County sales tax 1 Richmond tax and 25 Special tax.

1 The city increased its existing tax of 050 percent CNCD to 100 percent CNTU in addition to the Contra Costa countywide increase of 050 percent listed in the countywide table. The California state sales tax rate is currently. The Contra Costa County Sales Tax is 025.

A county-wide sales tax rate of 025 is applicable to localities in Contra Costa County in addition to the 6 California sales tax. You can print a 975. To build the countywide tax roll and allocate and account for property tax apportionments and assessments for all jurisdictions in.

San Pedro Los Angeles 9500. The Contra Costa County California sales tax is 825 consisting of 600 California state sales tax and 225 Contra Costa County local. Under 18 4.

On November 3 2020 Contra Costa County voters approved a half cent retail sales tax increase that will take effect on April 1 2021. 1788 rows Contra Costa. The minimum combined 2022 sales tax rate for Contra Costa County California is.

5-9 Years 5. 10 Years 77. On november 3 2020 contra costa county voters approved a half cent retail sales tax increase that.

A county-wide sales tax rate of 025 is. West Contra Costa Unified 2020 00600 2053-54 3. 1-4 Years 13.

The minimum combined 2022 sales tax rate for Contra Costa County California is 875. A Property Tax The purpose of the Property Tax Division is. Download all California sales tax rates by zip code.

Length of Time in Contra Costa County 1 year 5. This is the total of state and county sales tax. Contra Costa County Sales Tax 2021.

This is the total of state and county sales tax rates. Contra Costa California Tax Increase Clause.

Contra Costa County California Ballot Measures Ballotpedia

What Would A New Walnut Creek Sales Tax Pay For

Contra Costa County Fire Board Agrees To Move Forward With Annexation Process Of Fire Districts

Food And Sales Tax 2020 In California Heather

Homelessness In Contra Costa County

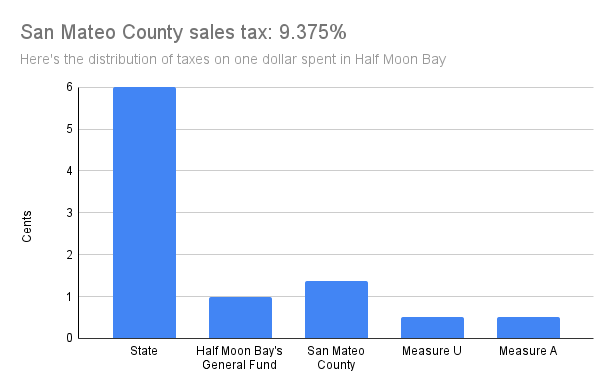

County Begins Collecting Higher Sales Tax Local News Stories Hmbreview Com

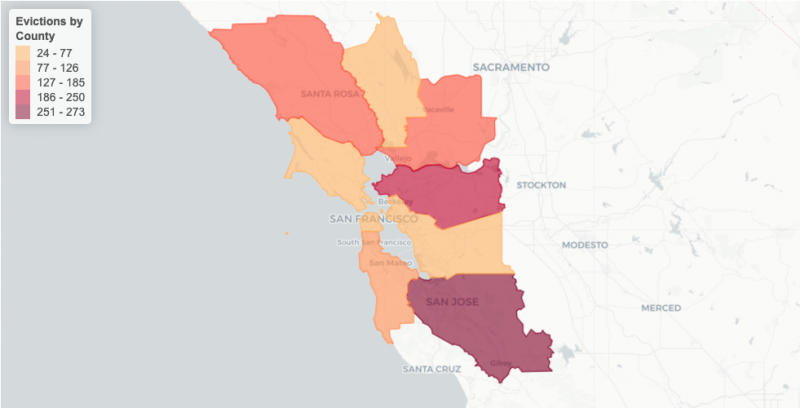

Santa Clara Contra Costa Top Bay Area Counties With Most Evictions During Pandemic Kqed

California City And County Sales And Use Tax Rates Cities Counties And Tax Rates California Department Of Tax And Fee Administration

How To File A Quarterly Sales Tax Return In California Taxjar

Election Costs Rise As Contra Costa Supervisors Ok 3 6 Billion 2020 2021 Budget

City Council To Discuss Endorsing Half Cent Sales Tax Increase

Contra Costa County Treasurer Tax Collector Facebook

Coronavirus Updates The Business Assistance Program Lafayette Chamber Of Commerce

Sales Taxes How Much What Are They For And Who Raised Them

Contra Costa County Treasurer Tax Collector

California City And County Sales And Use Tax Rates Cities Counties And Tax Rates California Department Of Tax And Fee Administration

Prop 19 Property Tax Exemptions From Reassessment Ccartoday Contra Costa Association Of Realtors